Tinplate’s Map Has Shifted—and Prices Are Telling You Where It Goes Next

CONSMOS GROUP

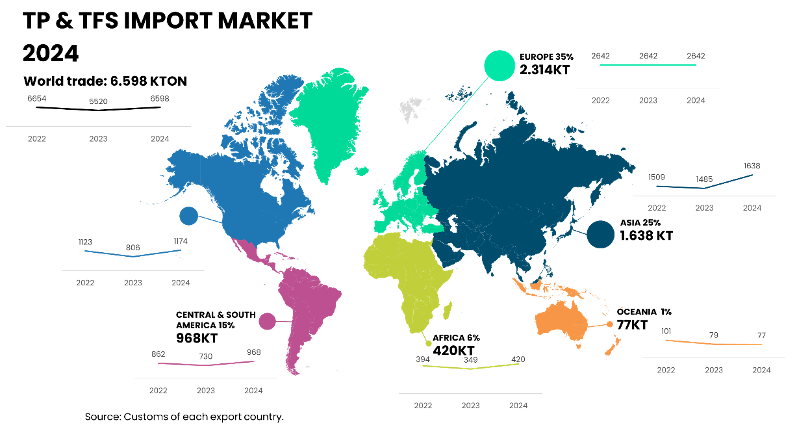

Global trade is quietly redrawn. Import flows for metal packaging have tilted toward Asia, while Europe, the U.S., and Japan have retrenched. That geography matters because it now sets how prices are formed and where risk shows up.

Why is Asia pulling more of the trade? Two forces. First, scale: China remains the gravitational center of global steel, shaping availability and export tempo even as domestic demand wobbles. Worldsteel’s 2024 totals keep China far ahead of any other producer, and customs data shows 2024 steel exports at their highest since 2015—a sign that surplus tons continue to seek buyers abroad. Second, demand: market research shows Asia as the fastest-growing region in metal packaging, reinforcing destination pull. Together, those fundamentals re-route supply toward Asia even before policy layers are considered.

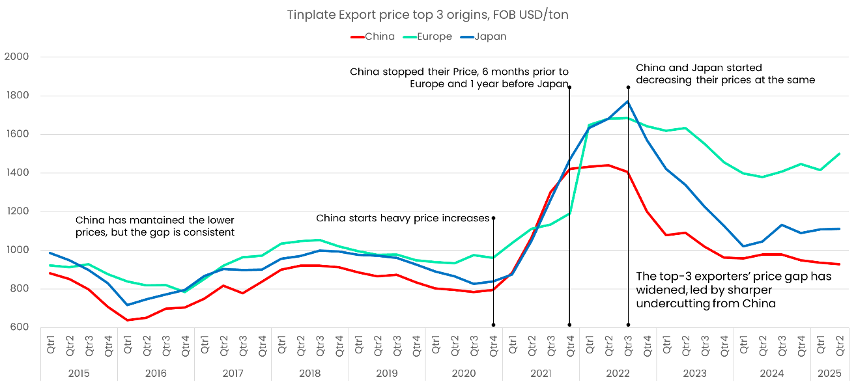

If the map changes, prices do too. Since the pandemic, the exporter spread has widened: China tends to turn earlier and from below, while European and Japanese offers respond later. You can see this in the graph below of monthly export prices (CN vs EU vs JP) normalized to the same spec and incoterms. That’s not just a curiosity, it’s a mechanism.

Chinese export offers consistently inflect earlier and at lower levels; subsequent adjustments in EU and Japanese quotes follow with a measurable lag, and export prices move accordingly.

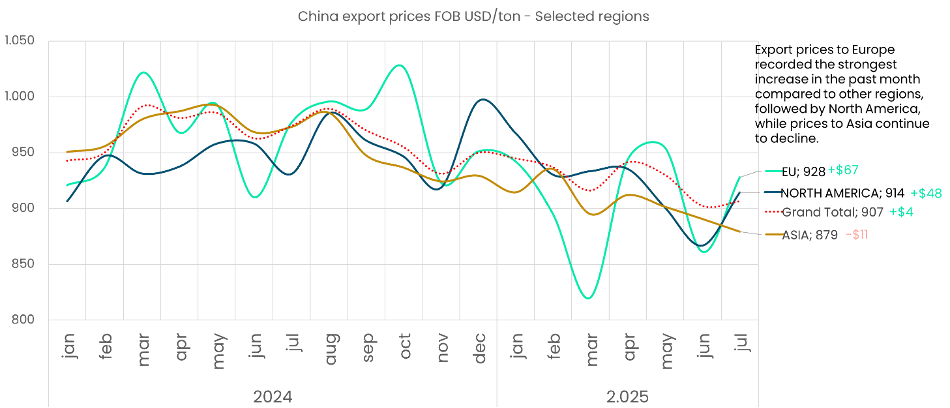

Destination now matters as much as origin. When reviewing split Chinese offers by where they go, the China → EU/NA lines slope up, reflecting remedy risk, compliance requirements, and longer-haul logistics that get priced into landed costs, while China → Asia slopes softer. That destination split preconditions the competitiveness wedge: since 2021, US–CN and EU–CN premia rarely close even when the base cools.

These pricing patterns aren’t happening in a vacuum. The policy “background noise” is getting louder—even if this is reserved in a full deep dive for Part 2. Two examples illustrate the signal: in May 2025 the EU imposed definitive anti-dumping duties of ~13–62% on Chinese tinplate and China’s strong export cadence has continued despite a softer home market.

As takeaway the competitiveness gap is opening under evolving remedies and carbon rules, cost advantage varies by market—not just by supplier—and it’s more than price: lead times, service reliability, allocation risk, and the compliance workload (CBAM data, audits, duty exposure) now shape total delivered value.